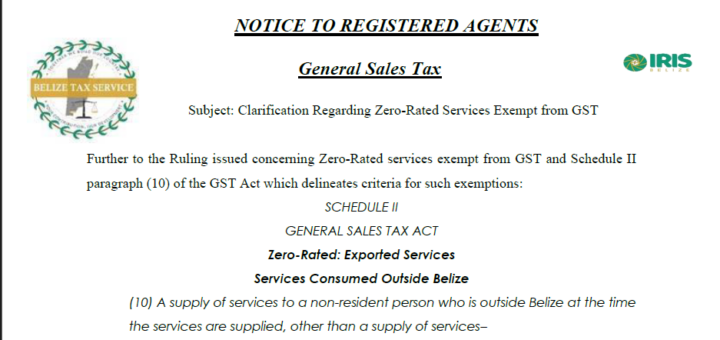

NOTICE TO REGISTERED AGENTS GENERAL SALES TAX

Subject: Clarification Regarding Zero-Rated Services Exempt from GST

Further to the Ruling issued concerning Zero-Rated services exempt from GST and Schedule II paragraph (10) of the GST Act which delineates criteria for such exemptions:

SCHEDULE II

GENERAL SALES TAX ACT

Zero-Rated: Exported Services

Services Consumed Outside Belize

(10) A supply of services to a non-resident person who is outside Belize at the time the services are supplied, other than a supply of services–