File Your P.A.Y.E. Supplementary and Summary

Instructions for filing TD4 Summary and Supplementary

- The Tax Identification Number (TIN) for the Business or Company should be entered on the TD4 Summary

- The social security number for each employee (The nine digits for the social security number are necessary since our system will reject any TD4 without the nine digits)

- The Tax Identification Number (TIN) for each employee must be included in “box C” of the TD4 supplementary. The Belize Tax Service office can provide you with a list of Tax Identification Number for the employees for whom you submitted a TD4 supplementary last year. The form BTS101 should be filled out COMPLETELY for any employee who does not have a TIN. The BTS101 form for new employee along with a copy of their social security card should be attached to the TD4 submitted.

- A tape or excel spreadsheet that shows the total emolument and taxes withheld should be attached to the TD4 Summary.

- A statement should also be attached showing the monthly breakdown of taxes withheld.

- If any withheld taxes were paid after the due date, penalties and interest incurred need to be paid before your TD4’s supplementary can be processed. Any outstanding taxes withheld also need to be paid before processing can begin.

- Kindly provide us with a valid email address and contact information for the person preparing the TD4.

Please be informed that if all supporting documents are not attached to the TD4 summaries upon submission this may result in a delay of the processing of your employees return.

Note for your employees when filing employee return: If banking information has change since last filing, please inform your employees to bring their credit union or bank account numbers along with copy of social security card when filing for an Employee Tax Refund. Employees who have accounts with the Bank of Nova Scotia and the Belize Bank need to state the branch to which their account is assigned. The deadline for your employee to file their TD4 return is Wednesday, March 31, 2021

Instructions for installing Form Docs :

- Download the Form Docs Installation Zip folder from above

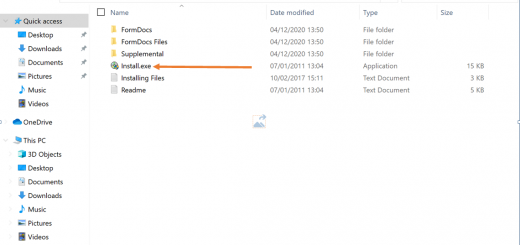

- Click Install.exe

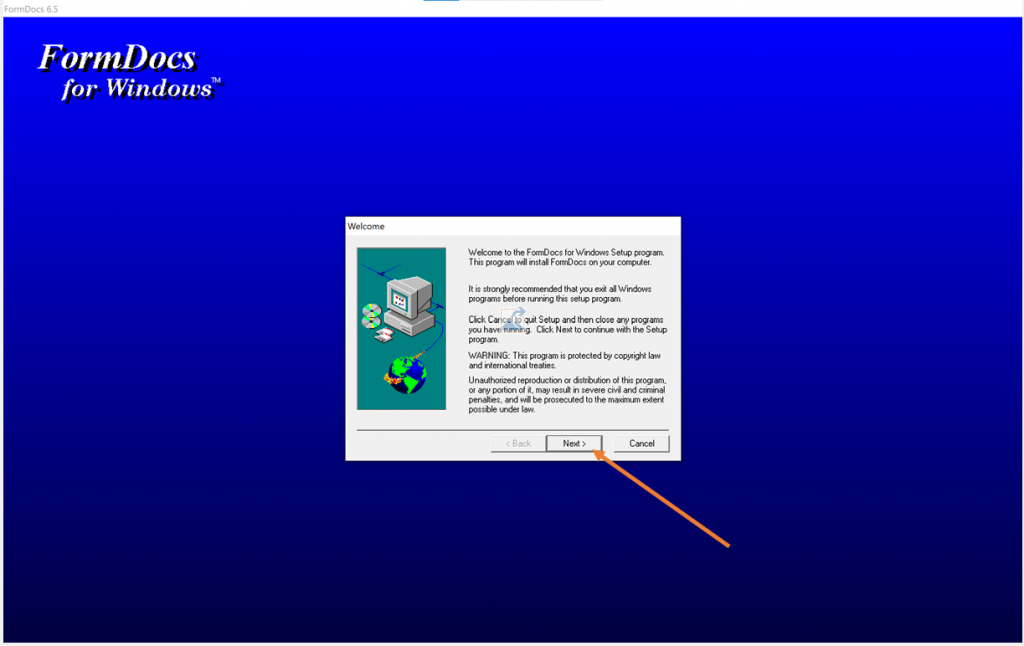

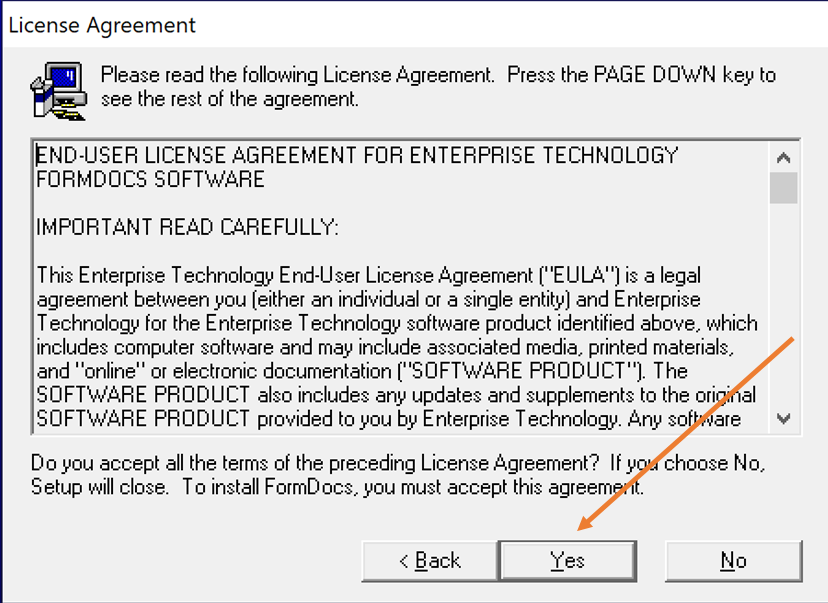

- Click Next then click accept at the license agreement screen

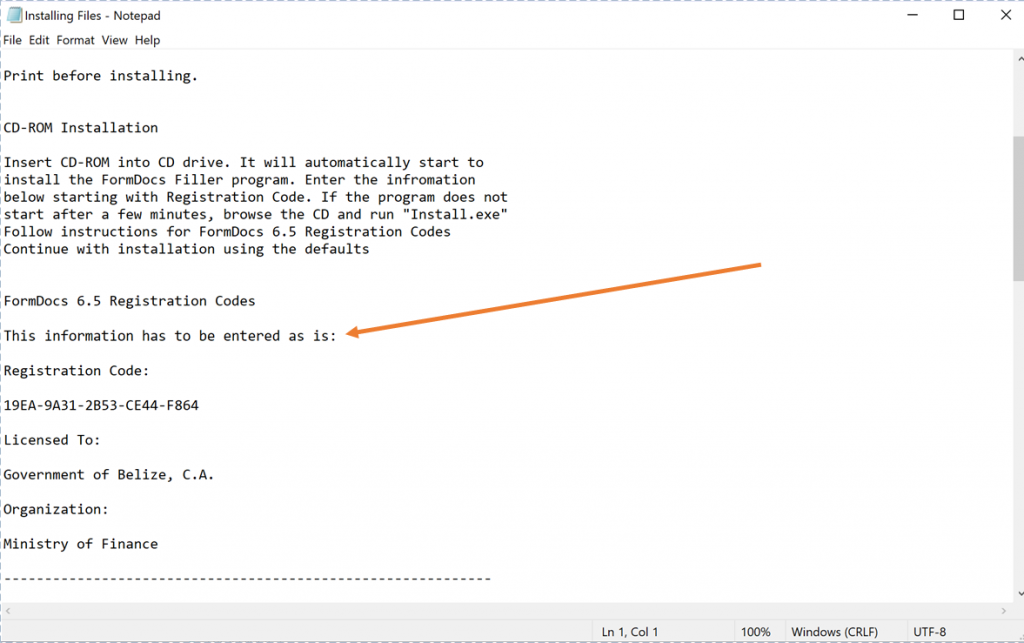

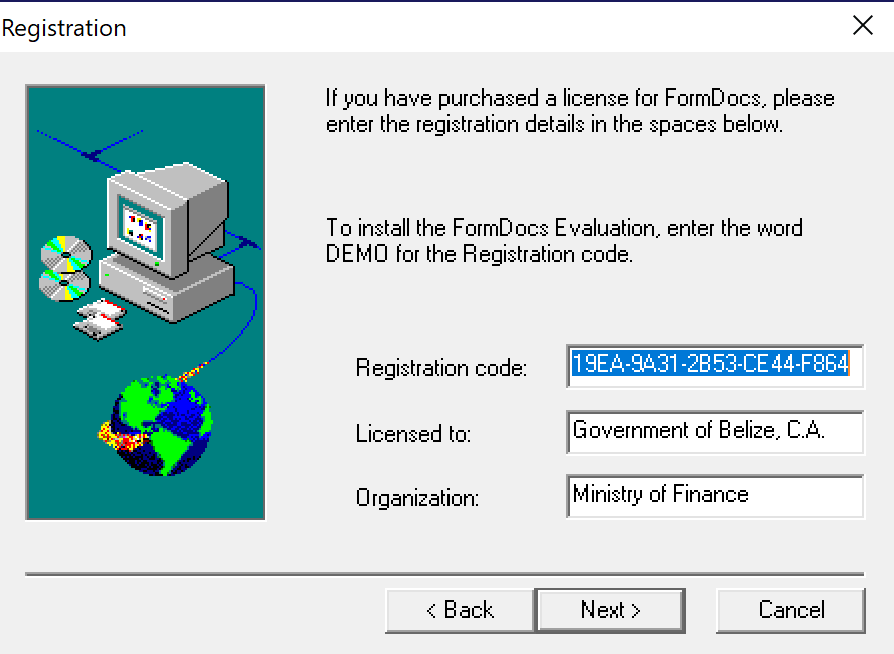

- copy and paste the registration information from the Installing files text document that is located in the Formdocs.zip folder

- Click Next, and follow the rest of the setup prompts until the application is installed.

- download the TD4 Supplementary and Summary , unzip the folder and save to a deignated destination on your computer.