1.

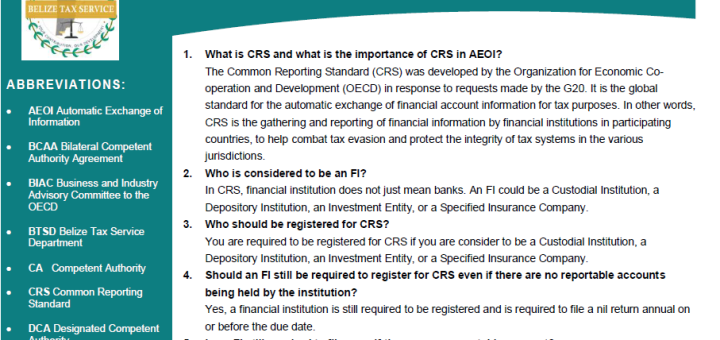

What is CRS and what is the importance of CRS in AEOI?

The Common Reporting Standard (CRS) was developed by the Organization for Economic Co-operation and Development (OECD) in response to requests made by the G20. It is the global standard for the automatic exchange of financial account information for tax purposes. In other words, CRS is the gathering and reporting of financial information by financial institutions in participating countries, to help combat tax evasion and protect the integrity of tax systems in the various jurisdictions.

2.

Who is considered to be an FI?

In CRS, financial institution does not just mean banks. An FI could be a Custodial Institution, a Depository Institution, an Investment Entity, or a Specified Insurance Company.

3.

Who should be registered for CRS?

You are required to be registered for CRS if you are consider to be a Custodial Institution, a Depository Institution, an Investment Entity, or a Specified Insurance Company.