AEOI/BEPS News

AEOI & BEPS News and Press releases

REQUEST FOR EXPRESSIONS OF INTEREST CONSULTING SERVICES

The Government of Belize has received financing from the Inter-American Development Bank (IDB), toward the cost of the Strengthening of Tax Administration Project (STAP) and intends to apply part of the proceeds for consulting services.

The consulting services (“the Services”) for a Consulting Firm to develop a Data Governance Strategy and Framework for the Belize Tax service Department (BTSD).

Specific objectives for this Consultancy:

“To develop and institutionalize a comprehensive Data Governance Strategy and Framework for the BTSD, ensuring that data assets are effectively managed, protected, and utilized to support evidence-based policy formulation, compliance management, and operational efficiency”.

NOTICE TO ALL COMPANIES FORMALLY KNOWN AS IBCS REQUIREMENT TO FILE ANNUAL RETURN

The Belize Tax Service Department (BTSD) reminds companies formally known as International Business Companies (IBCs) of their obligation to file annual Business Tax returns.

Please note that returns for the 2024 basis year were due on March 31st, 2025. Companies are further reminded of the new late filing penalties that came into effect on January 1st, 2025. To avoid these penalties, you must file 2024 annual returns by 31st December 2025.

NOTICE TO FINANCIAL INSTITUTIONS SELF-CERTIFICATION

The Director General wishes to inform all Financial Institutions (FIs) that valid self-certification must be collected when updating pre-existing accounts and upon opening of all new accounts. If a valid TIN cannot be obtained or verified at account opening the FI must make reasonable efforts to obtain the missing information (e.g. contacting the account holder). The TIN must align with the residence address held on record. If there are any inconsistencies between the TIN and other account-holder data, the FI must take reasonable steps to obtain a valid TIN or provide an explanation with supporting documents.

NOTICE TO PERSONS MAKING WIRE TRANSFER

The Director General wishes to inform all persons wiring transfers to the Department that the National Bank of Belize applies a service charge of BZD $50.00 to all incoming wire transfers.

FAQs CRS AEOI Portal

1.

What is CRS and what is the importance of CRS in AEOI?

The Common Reporting Standard (CRS) was developed by the Organization for Economic Co-operation and Development (OECD) in response to requests made by the G20. It is the global standard for the automatic exchange of financial account information for tax purposes. In other words, CRS is the gathering and reporting of financial information by financial institutions in participating countries, to help combat tax evasion and protect the integrity of tax systems in the various jurisdictions.

2.

Who is considered to be an FI?

In CRS, financial institution does not just mean banks. An FI could be a Custodial Institution, a Depository Institution, an Investment Entity, or a Specified Insurance Company.

3.

Who should be registered for CRS?

You are required to be registered for CRS if you are consider to be a Custodial Institution, a Depository Institution, an Investment Entity, or a Specified Insurance Company.

Belize CRS Guidance

This Guidance Note is issued to assist Reporting Financial Institutions in understanding their

obligations, to increase compliance, educate, enhance efficiency, and reduce errors in reporting.

The OECD has developed extensive and comprehensive materials for the consistent application

and interpretation of the CRS by all jurisdictions. This Guidance Note is specific to Belize and is not

intended to replace the CRS Standards and implementation guidelines as referenced to below.

Financial Institutions may seek additional professional advice as it relates to CRS. Future

amendments to the legislation may be included in this note periodically.

NOTICE OF FILING OF CBC REPORTING

Regulation 5(3) of the CbC Regulations provides that Multinational

Enterprises (MNEs), not being the Ultimate Parent Entity, shall comply

with local filing obligation by filing CbC reports to the Belize Tax Service

Department, under the circumstances stated therein.

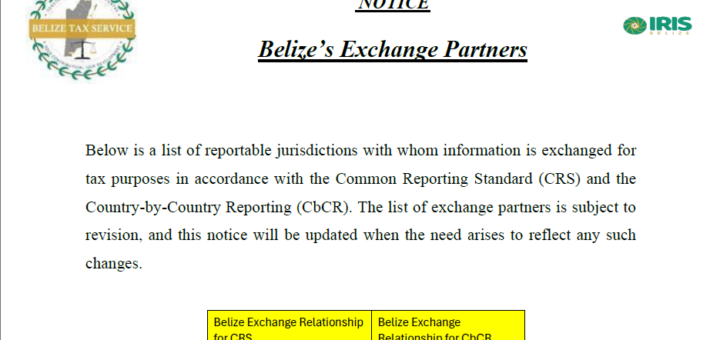

BELIZE EXCHANGE PARTNERS

Below is a list of reportable jurisdictions with whom information is exchanged for tax purposes in accordance with the Common Reporting Standard (CRS) and the Country-by-Country Reporting (CbCR). The list of exchange partners is subject to revision, and this notice will be updated when the need arises to reflect any such changes.

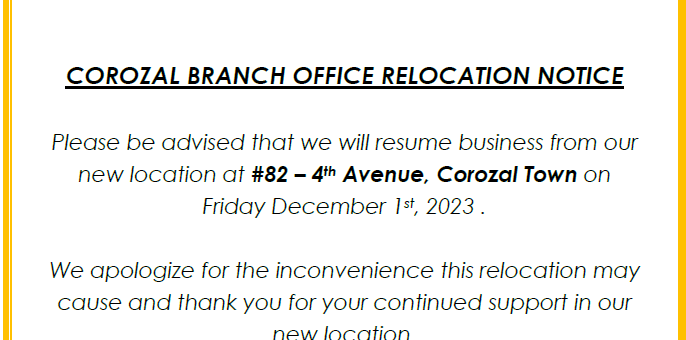

COROZAL OFFICE CLOSURE AND RELOCATION

Kindly be advised that our Corozal Branch Office will be closed from Wednesday November 29th to November 30th, 2023 for relocation to …..